Some Known Questions About Transaction Advisory Services.

Unknown Facts About Transaction Advisory Services

Table of ContentsThe Ultimate Guide To Transaction Advisory ServicesThe 3-Minute Rule for Transaction Advisory ServicesHow Transaction Advisory Services can Save You Time, Stress, and Money.What Does Transaction Advisory Services Mean?Unknown Facts About Transaction Advisory Services

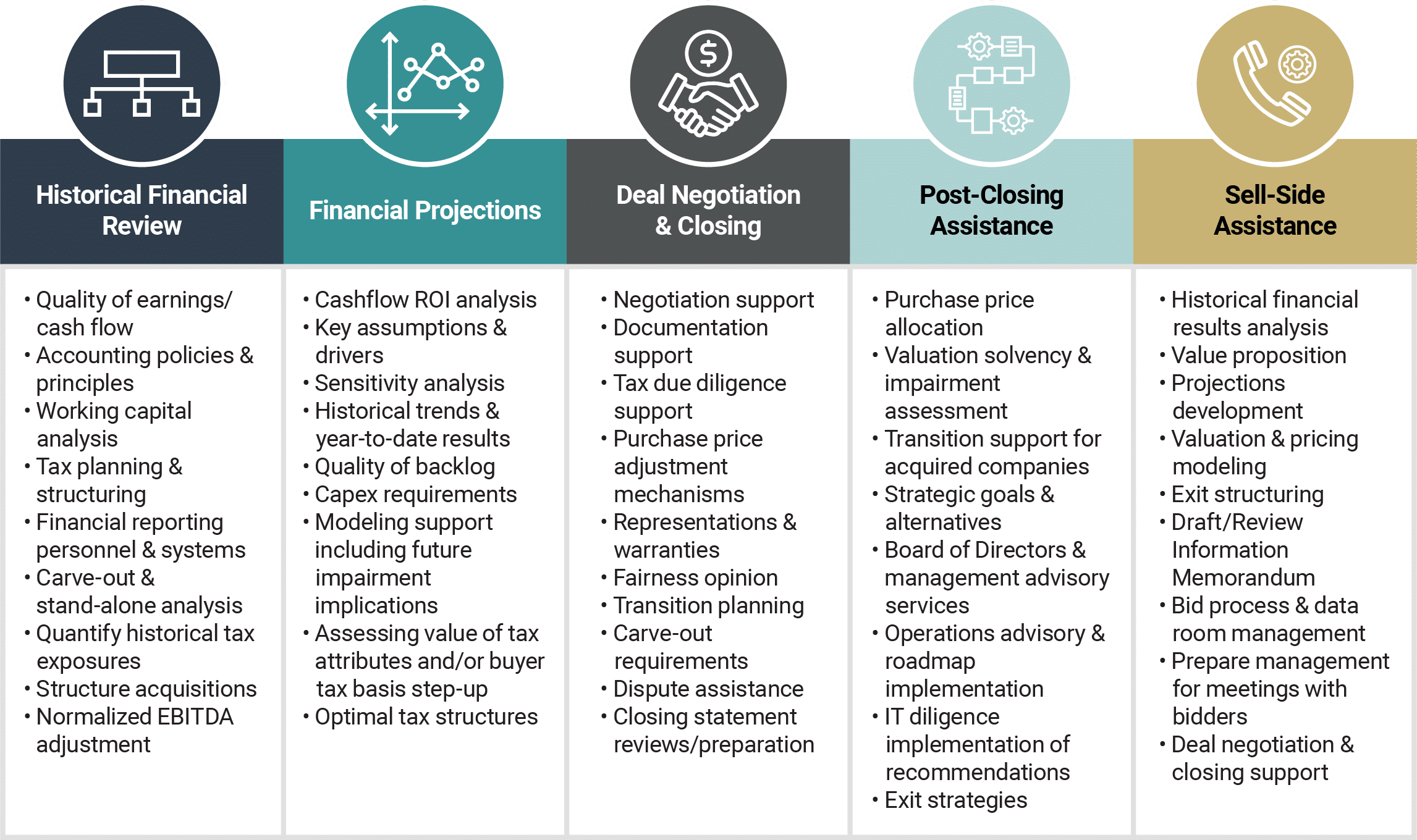

This action makes certain the company looks its ideal to prospective customers. Obtaining the business's value right is critical for an effective sale.Purchase consultants action in to help by obtaining all the required info organized, answering questions from customers, and setting up sees to the service's area. This develops trust with buyers and keeps the sale relocating along. Obtaining the most effective terms is vital. Transaction advisors use their expertise to aid local business owner manage hard negotiations, satisfy purchaser assumptions, and framework deals that match the proprietor's objectives.

Satisfying lawful policies is vital in any type of service sale. They help organization owners in planning for their following steps, whether it's retired life, starting a new venture, or managing their newly found wide range.

Transaction advisors bring a riches of experience and understanding, ensuring that every element of the sale is managed professionally. Through calculated prep work, evaluation, and negotiation, TAS helps company proprietors attain the greatest feasible list price. By ensuring legal and regulatory compliance and handling due persistance along with various other offer group participants, purchase experts minimize potential risks and liabilities.

3 Easy Facts About Transaction Advisory Services Explained

By contrast, Big 4 TS teams: Service (e.g., when a prospective purchaser is carrying out due diligence, or when an offer is shutting and the buyer needs to integrate the business and re-value the vendor's Annual report). Are with charges that are not connected to the bargain shutting efficiently. Gain costs per engagement someplace in the, which is much less than what financial investment financial institutions gain also on "little deals" (but the collection chance is also a lot greater).

, however they'll focus a lot more on audit and assessment and less on subjects like LBO modeling., and "accounting professional only" topics like trial equilibriums and exactly how to walk with events making use of debits and credit reports rather than monetary statement adjustments.

Our Transaction Advisory Services Statements

Specialists in the TS/ FDD groups might also interview management about whatever over, and they'll create a thorough report with their findings at the end of the process.

, and the general form looks like this: The entry-level role, where you do a lot of information and financial analysis (2 years for a promo from right here). The next degree up; comparable work, yet you get the more intriguing bits (3 years for a promotion).

Specifically, it's difficult to obtain promoted past the Manager degree since couple of people leave the job at that phase, and you need to begin showing proof of your capability to generate earnings to advance. Allow's start with the hours and lifestyle because those are simpler to describe:. There are occasional late nights and weekend break job, but nothing like the frenzied nature of investment financial.

There are cost-of-living adjustments, so anticipate lower compensation if you're in a more affordable location outside significant financial (Transaction Advisory Services). For all placements other than Partner, the base pay consists of the bulk of the total payment; the year-end bonus could be a max of 30% of your base pay. Often, the best method read what he said to boost your revenues is to change to a different company and bargain for a greater salary and perk

The Main Principles Of Transaction Advisory Services

At this stage, you need to just remain and make a run for a Partner-level function. find this If you want to leave, possibly move to a customer and do their valuations and due persistance in-house.

The primary trouble is that since: You usually require to join another Huge 4 group, such as audit, and job there for a few years and after that move right into TS, work there for a couple of years and afterwards relocate right into IB. And there's still no guarantee of winning this IB duty since it relies on your region, customers, and the employing market at the time.

Longer-term, there is additionally some risk of and due to the fact that evaluating a firm's historical economic information is not specifically rocket science. Yes, people will certainly always require to be entailed, however with advanced innovation, reduced headcounts might possibly support client involvements. That said, the Deal Providers group beats audit in regards to pay, work, and departure opportunities.

If you liked this post, you might be curious about reading.

Our Transaction Advisory Services Statements

Create sophisticated financial structures that help in figuring out the real market value of a company. Offer go to this website advisory work in relation to company appraisal to assist in bargaining and rates structures. Explain the most suitable type of the deal and the sort of factor to consider to use (cash money, stock, gain out, and others).

Execute combination planning to establish the process, system, and business changes that may be required after the offer. Establish standards for integrating departments, technologies, and company processes.

Recognize possible decreases by minimizing DPO, DIO, and DSO. Examine the prospective customer base, sector verticals, and sales cycle. Take into consideration the possibilities for both cross-selling and up-selling (Transaction Advisory Services). The functional due diligence uses vital understandings into the performance of the company to be gotten worrying risk evaluation and worth production. Determine temporary modifications to funds, banks, and systems.